- 47% stocks of NYSE rose,51% fell

- 52% stocks of NASDAQ rose,45% fell

- 65% stocks of TSX rose,28% fell

😷🧼🏡

Table of Contents

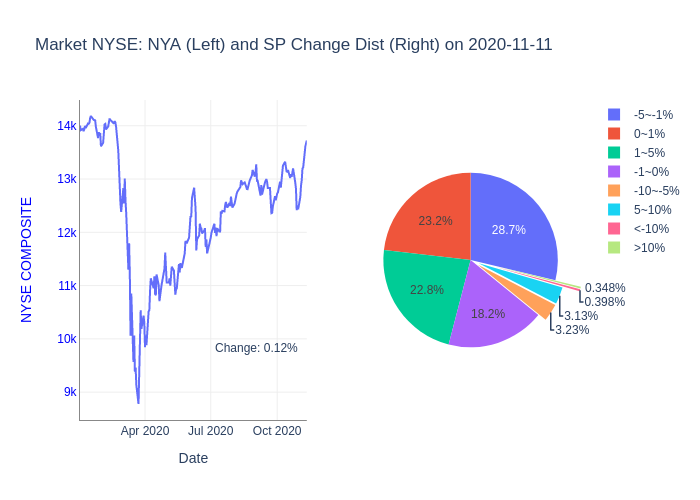

Based on data of 2011 stocks traded on NYSE

- 46.9% stocks rose,50.6% stocks fell

- 3.5% stocks jumped more than 5%,3.6% stocks dropped more than 5%

- 41.4% stocks swang between -1% and 1%

NYSE top 10 stocks:

Top Moneyflow:💸:

Most active:🔥:

Top gainers:🚀:

Based on data of 2137 stocks traded on NASDAQ

- 51.9% stocks rose,45.2% stocks fell

- 8.6% stocks jumped more than 5%,4.7% stocks dropped more than 5%

- 31.4% stocks swang between -1% and 1%

NASDAQ top 10 stocks:

Top Moneyflow:💸:

Most active:🔥:

Top gainers:🚀:

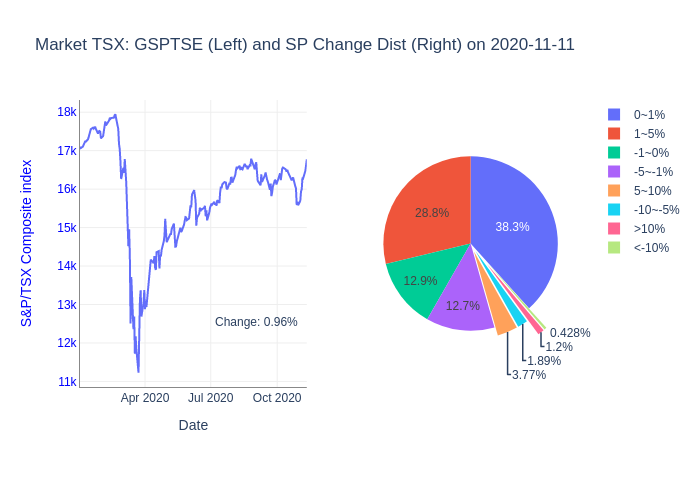

Based on data of 1167 stocks traded on TSX

- 65.0% stocks rose,27.9% stocks fell

- 4.9% stocks jumped more than 5%,2.3% stocks dropped more than 5%

- 51.2% stocks swang between -1% and 1%

TSX top 10 stocks:

Top Moneyflow:💸:

Most active:🔥:

Top gainers:🚀:

GC.TO 35%

LNR.TO 16%

PL.TO 11%

DCBO.TO 11%

CWEB.TO 8%

FRU.TO 8%

BLDP.TO 8%

SHOP.TO 7%

MRE.TO 7%

CCO.TO 5%

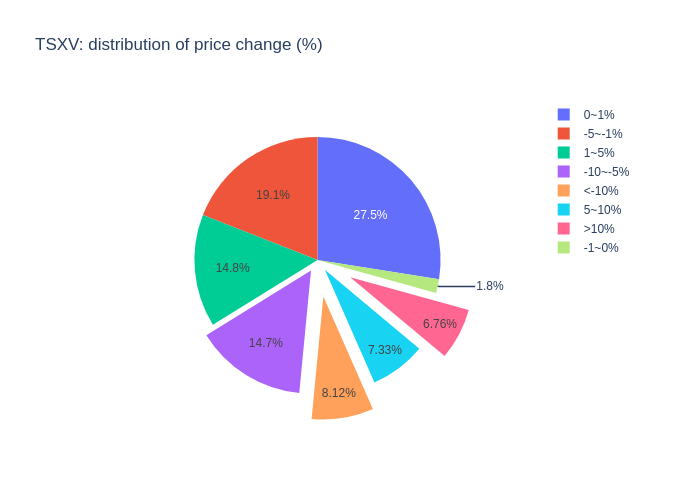

Based on data of 887 stocks traded on TSXV

- 29.9% stocks rose,43.6% stocks fell

- 13.5% stocks jumped more than 5%,22.8% stocks dropped more than 5%

- 29.3% stocks swang between -1% and 1%

TSXV top 10 stocks:

Top Moneyflow:💸:

Most active:🔥:

Top gainers:🚀:

KES.V 20%

ETMC.V 17%

ZON.V 17%

FUND.V 14%

EW.V 12%

GPV.V 11%

GPH.V 10%

FNR.V 10%

GSPR.V 10%

CTS.V 10%

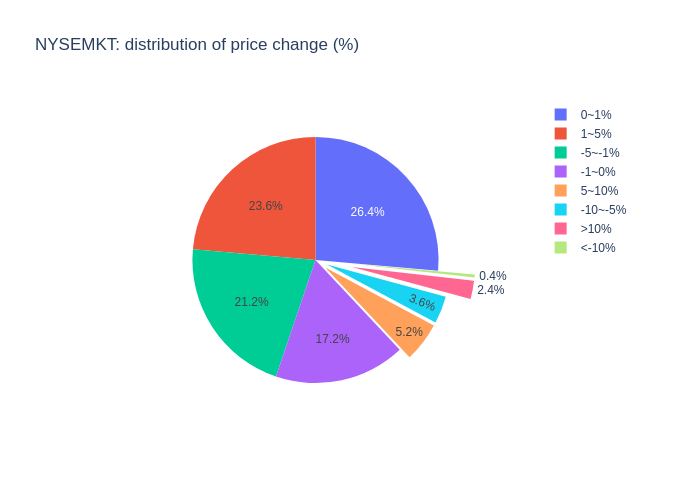

Based on data of 250 stocks traded on NYSEMKT

- 53.6% stocks rose,42.4% stocks fell

- 7.6% stocks jumped more than 5%,4.0% stocks dropped more than 5%

- 43.6% stocks swang between -1% and 1%