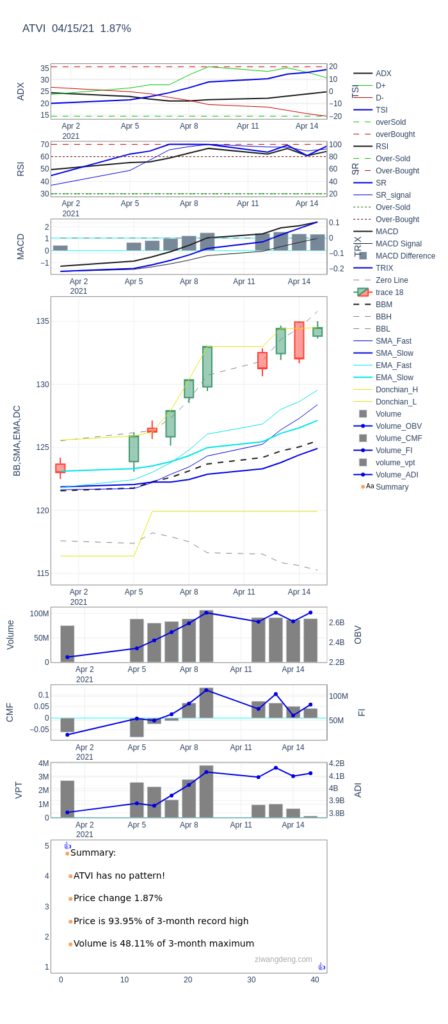

The following example shows you how to draw multiple subplots with different widths and heights. It also tells you the answers to some other questions.

- How to do technical analysis of a stock?

- How to draw double y-axis plot?

- How to set height of a subplot?

import numpy as np

import talib

import emoji

import pandas as pd

from datetime import datetime,date

from ta import add_all_ta_features

from ta.utils import dropna

import plotly.graph_objects as go

import chart_studio.plotly as py

from plotly.subplots import make_subplots

candleRank=pd.read_csv('CandleStick_rankings.csv')

candle_names = talib.get_function_groups()['Pattern Recognition']

candleRank=candleRank.set_index('Unnamed: 0')

#------------------------------------

Year=2020

Month=5

fnlist='nasdq100List.txt'

fns=pd.read_csv(fnlist)

path='nasdq100/'

#-------------------------------------

for fn0 in fns.symbles[:1]:

stockname=fn0.replace('.csv','')

fn=path + stockname + '.csv'

fn=fn.replace(' ','')

figfilename="images/nasdq100/" + stockname + '_Technical_Analysis.png'

figfilename=figfilename.replace(' ','')

df0=pd.read_csv(fn)

#! convert Date to datetime

df0['Date']=df0['Date'].astype('datetime64[ns]')

df0=df0.rename(columns={'Date':'date'})

#! drop nan data

df0 = dropna(df0)

df0 = add_all_ta_features(df0, open="Open", high="High", low="Low", close="Close", volume="Volume")

df=df0.iloc[-62:]

minVolume=df['Volume'].min()

maxVolume=df['Volume'].max()

minClose=df['Close'].min()

maxClose=df['Close'].max()

strdate=df["date"].dt.strftime("%m/%d/%y").iloc[-1]

tradingClosePCT=np.round((df0.Close.iloc[-1]/maxClose)*100,2)

tradingVolumePCT=np.round((df0.Volume.iloc[-1]/maxVolume)*100,2)

str4Volume="Volume is " + str(tradingVolumePCT) +'% of 3-month maximum'

if(df['Volume'].tail(1).values ==minVolume):

str4Volume='Trading volume hits 3-month record low.'

if(df['Volume'].tail(1).values ==maxVolume):

str4Volume='Trading volume hits 3-month record high.'

str4Close='Price is ' + str(tradingClosePCT) +'% of 3-month record high'

if(df.Close.tail(1).values==minClose):

str4Close='Close price dips to the 3-month record low.'

if(df.Close.tail(1).values==maxClose):

str4Close='Close price soars to the 3-month record high.'

ratePCT=np.round((df0.Close.iloc[-1]/df0.Close.iloc[-2]-1)*100,2)

strPriceChange='Price change ' + str(ratePCT) +'%'

if(ratePCT>5):

strPriceChange='Price soars ' + str(ratePCT) +'%'

if(ratePCT<-5):

strPriceChange='Price dips ' + str(ratePCT) +'%'

df1=df0.iloc[-5:]

op=df1['Open']

hi=df1['High']

lo=df1['Low']

cl=df1['Close']

pattern_columns=['Open_2','High_2','Low_2','Close_2','Open_1','High_1','Low_1','Close_1'] \

+ list(df.columns) + ['PatternName','Bull2Bear']

df_pattern=pd.DataFrame(columns=pattern_columns)

for candle in candle_names:

df[candle] = getattr(talib, candle)(op, hi, lo, cl)

df=df[candle_names].tail(1)

#print(df[candle_names])

df_candles=df[candle_names].sum(axis=1)

if(df_candles.values==0):

aboutThePatterns = stockname + " has no pattern!"

else:

for candle in candle_names:

if(df[candle].values==0):

df=df.drop(candle,axis=1)

aboutThePatterns=''

for col in df.columns:

if(df[col].values<0):

bull2bear=col + '_Bear'

else:

bull2bear=col+ '_Bull'

if (bull2bear in list(candleRank.index)):

strRank=str(candleRank.loc[bull2bear,'Rank'])

else:

strRank=''

aboutThePatterns = aboutThePatterns + \

"Pattern(s): " + \

bull2bear + ",Rank=" + strRank

aboutThePatterns=aboutThePatterns.replace(' ',' ').replace('CDL','')

s1='<img src="https://github.com/ziwangdeng/TechnicalAnalysis/blob/master/nasdq/'

s2=stockname + '_Technical_Analysis.png?raw=true"'

s2=s2.replace(' ','').replace('.TO','_TO')

s3=' alt="Technical_Analysis" width="100%" height="1600"><br>'

ss=s1 + s2 + s3

print(ss)

df=df0.iloc[-10:]

#! set subplot heights

fig = make_subplots(

rows=12, cols=1,

specs=[

[{"rowspan":1,"secondary_y": True}],

[{"rowspan":1,"secondary_y": True}],

[{"rowspan":1,"secondary_y": True}],

[{"rowspan":4,"secondary_y": False}],

[None],

[None],

[None],

[{"rowspan":1,"secondary_y": True}],

[{"rowspan":1,"secondary_y": True}],

[{"rowspan":1,"secondary_y": True}],

[{"rowspan":2,"secondary_y": False}],

[None],

])

# ADX

fig.add_trace(go.Scatter(x=df.date,

y=df.trend_adx,

mode='lines',

name="ADX",

line=dict(color='rgb(30,30,30)',

width=2)),row=1,col=1,secondary_y=False)

fig.add_trace(go.Scatter(x=df.date,

y=df.trend_adx_pos,

mode='lines',

name="D+",

line=dict(color='rgb(0,200,0)',

width=1)),row=1,col=1,secondary_y=False)

fig.add_trace(go.Scatter(x=df.date,

y=df.trend_adx_neg,

mode='lines',

name="D-",

line=dict(color='rgb(200,0,0)',

width=1)),row=1,col=1,secondary_y=False)

#TSI

#! double yaxes

fig.add_trace(go.Scatter(x=df.date,

y=df.momentum_tsi,

mode='lines',

name="TSI",

line=dict(color='rgb(0,0,230)',

width=2)),row=1,col=1,secondary_y=True)

x1=df.date.iloc[0]

x2=df.date.iloc[-1]

y1=-20

y2=20

fig.add_trace(go.Scatter(x=[x1,x2],

y=[y1,y1],

mode='lines',

name='overSold',

line=dict(color='rgb(0,200,0)',

width=1,dash='dash')),row=1,col=1,secondary_y=True)

fig.add_trace(go.Scatter(x=[x1,x2],

y=[y2,y2],

mode='lines',

name='overBought',

line=dict(color='rgb(200,0,0)',

width=1,dash='dash')),row=1,col=1,secondary_y=True)

#RSI

fig.add_trace(go.Scatter(x=df.date,

y=df.momentum_rsi,

mode='lines',

name="RSI",

line=dict(color='rgb(30,30,30)',

width=2)),row=2,col=1,secondary_y=False)

x1=df.date.iloc[0]

x2=df.date.iloc[-1]

y1=30

y2=70

fig.add_trace(go.Scatter(x=[x1,x2],

y=[y1,y1],

mode='lines',

name='Over-Sold',

line=dict(color='rgb(0,200,0)',

width=1,dash='dash')),row=2,col=1,secondary_y=False)

fig.add_trace(go.Scatter(x=[x1,x2],

y=[y2,y2],

mode='lines',

name='Over-Bought',

line=dict(color='rgb(200,0,0)',

width=1,dash='dash')),row=2,col=1,secondary_y=False)

# SR

fig.add_trace(go.Scatter(x=df.date,

y=df.momentum_stoch,

mode='lines',

name="SR",

line=dict(color='rgb(0,0,230)',

width=2)),row=2,col=1,secondary_y=True)

fig.add_trace(go.Scatter(x=df.date,

y=df.momentum_stoch_signal,

mode='lines',

name="SR_signal",

line=dict(color='rgb(0,0,230)',

width=1)),row=2,col=1,secondary_y=True)

x1=df.date.iloc[0]

x2=df.date.iloc[-1]

y1=20

y2=80

fig.add_trace(go.Scatter(x=[x1,x2],

y=[y1,y1],

mode='lines',

name='Over-Sold',

line=dict(color='rgb(0,100,0)',

width=1,dash='dot')),row=2,col=1,secondary_y=True)

fig.add_trace(go.Scatter(x=[x1,x2],

y=[y2,y2],

mode='lines',

name='Over-Bought',

line=dict(color='rgb(100,0,0)',

width=1,dash='dot')),row=2,col=1,secondary_y=True)

#MACD

fig.add_trace(go.Scatter(x=df['date'],

y=df.trend_macd,

mode='lines',

line=dict(color='rgb(30,30,30)',width=2), name="MACD"),row=3,col=1,secondary_y=False)

fig.add_trace(go.Scatter(x=df['date'],

y=df.trend_macd_signal,mode='lines',

line=dict(color='rgb(30,30,30)',width=1),

name="MACD Signal"),row=3,col=1,secondary_y=False)

fig.add_trace(go.Bar(x=df['date'],

y=df.trend_macd_diff,

base=0,

marker_color='lightslategrey',

name="MACD Difference"),row=3,col=1,secondary_y=False)

#TRIX

fig.add_trace(go.Scatter(x=df.date,

y=df.trend_trix,

mode='lines',

name="TRIX",

line=dict(color='rgb(0,0,230)',

width=2)),row=3,col=1,secondary_y=True)

x1=df.date.iloc[0]

x2=df.date.iloc[-1]

y1=0

y2=0

fig.add_trace(go.Scatter(x=[x1,x2],

y=[y1,y1],

mode='lines',

name='Zero Line',

line=dict(color='rgb(130,130,130)',

width=1,dash='dash')),row=3,col=1,secondary_y=True)

# bollinger band

fig.add_trace(go.Candlestick(x=df['date'],

open=df['Open'],

high=df['High'],

low=df['Low'],

close=df['Close']

),row=4,col=1)

fig.add_trace(go.Scatter(x=df.date,

y=df.volatility_bbm,

mode='lines',

name="BBM",

line=dict(color='rgb(30,30,30)', width=2, dash='dash')),row=4,col=1)

fig.add_trace(go.Scatter(x=df.date,

y=df.volatility_bbh,

mode='lines', name="BBH",

line=dict(color='rgb(130,130,130)', width=1, dash='dash')),row=4,col=1)

fig.add_trace(go.Scatter(x=df.date,

y=df.volatility_bbl,

mode='lines',

name="BBL",

line=dict(color='rgb(130,130,130)', width=1, dash='dash')),row=4,col=1)

fig.add_trace(go.Scatter(x=df.date,

y=df.trend_sma_fast,

mode='lines',

name="SMA_Fast",

line=dict(color='rgb(0,0,230)', width=1)),row=4,col=1)

fig.add_trace(go.Scatter(x=df.date,

y=df.trend_sma_slow,

mode='lines',

name="SMA_Slow",

line=dict(color='rgb(0,0,230)', width=2)),row=4,col=1)

fig.add_trace(go.Scatter(x=df.date,

y=df.trend_ema_fast,

mode='lines',

name="EMA_Fast",

line=dict(color='rgb(0,230,230)', width=1)),row=4,col=1)

fig.add_trace(go.Scatter(x=df.date,

y=df.trend_ema_slow,

mode='lines',

name="EMA_Slow",

line=dict(color='rgb(0,230,230)', width=2)),row=4,col=1)

fig.add_trace(go.Scatter(x=df.date,

y=df.volatility_dch,

mode='lines',

name="Donchian_H",

line=dict(color='rgb(230,230,0)', width=1)),row=4,col=1)

fig.add_trace(go.Scatter(x=df.date,

y=df.volatility_dcl,

mode='lines',

name="Donchian_L",

line=dict(color='rgb(230,230,0)', width=1)),row=4,col=1)

# Volume

fig.add_trace(go.Bar(x=df.date,

y=df.Volume,

base=0,

name="Volume",

marker_color='rgb(130,130,130)'),row=8,col=1,secondary_y=False)

# Volume OBV

fig.add_trace(go.Scatter(x=df.date,

y=df.volume_obv,

name="Volume_OBV",

line=dict(color='rgb(0, 0, 230)',

width=2)),row=8,col=1,secondary_y=True)

# Chaikin Money Flow (CMF)

basevalue=df.volume_cmf.min

fig.add_trace(go.Bar(x=df.date,

y=df.volume_cmf,

name="Volume_CMF",

marker_color='rgb(130,130,130)'),row=9,col=1,secondary_y=False)

# FI

# basevalue=df.volume_cmf.min

fig.add_trace(go.Scatter(x=df.date,

y=df.volume_fi,

name="Volume_FI",

line=dict(color='rgb(0, 0, 230)',

width=2)),row=9,col=1,secondary_y=True)

# Volume-price Trend (VPT)

fig.add_trace(go.Bar(x=df.date,

y=df.volume_vpt,

base=0,

name="volume_vpt",

marker_color='rgb(130,130,130)'),row=10,col=1,secondary_y=False)

# ADI

fig.add_trace(go.Scatter(x=df.date,

y=df.volume_adi,

name="Volume_ADI",

line=dict(color='rgb(0, 0, 230)',

width=2)),row=10,col=1,secondary_y=True)

fig.add_annotation(

x=1,

y=5,

ax=1,ay=0,

font=dict(color='blue'),

text=emoji.emojize(':thumbs_up:'),row=11,col=1)

fig.add_annotation(

x=41,

y=1,

ax=1,ay=0,

font=dict(color='blue'),

text=emoji.emojize(':thumbs_up:'),row=11,col=1)

fig.add_trace(go.Scatter(

x=[1,1.5,1.5,1.5,1.5,1.5],

y=[4.75,4.00,3.25,2.5,1.75],

name="Summary",

mode='markers+text',

text=['Summary:',aboutThePatterns,strPriceChange,str4Close,str4Volume],

textposition='middle right',

textfont=dict(family='sans serif',

size=14,

color='black')),row=11,col=1)

fig.add_annotation( x=35,

y=1.25,

ax=1,ay=0,font=dict(color='#aaaaaa'),

text="ziwangdeng.com",row=11,col=1)

fig.update_yaxes(title_text="ADX", row=1, col=1,secondary_y=False,

showline=True,linecolor='#888888', mirror=True,

showgrid=True, gridwidth=1, gridcolor='#eeeeee')

fig.update_yaxes(title_text="TSI", row=1, col=1,secondary_y=True,

showline=True,linecolor='#888888', mirror=True,

showgrid=True, gridwidth=1, gridcolor='#eeeeee')

fig.update_xaxes(row=1,col=1,

showline=True,linecolor='#888888', mirror=True,

showgrid=True, gridwidth=1, gridcolor='#eeeeee')

fig.update_yaxes(title_text="RSI", row=2, col=1,secondary_y=False,

showline=True,linecolor='#888888', mirror=True,

showgrid=True, gridwidth=1, gridcolor='#eeeeee')

fig.update_yaxes(title_text="SR", row=2, col=1,secondary_y=True,

showline=True,linecolor='#888888', mirror=True,

zerolinewidth=1, zerolinecolor='#00ffff',

showgrid=True, gridwidth=1, gridcolor='#eeeeee')

fig.update_xaxes(row=2,col=1,

showline=True,linecolor='#888888', mirror=True,

showgrid=True, gridwidth=1, gridcolor='#eeeeee')

fig.update_yaxes(title_text="MACD", row=3, col=1,secondary_y=False,

showline=True,linecolor='#888888', mirror=True,

zerolinewidth=1, zerolinecolor='#00ffff',

showgrid=True, gridwidth=1, gridcolor='#eeeeee')

fig.update_yaxes(title_text="TRIX", row=3, col=1,secondary_y=True,

showline=True,linecolor='#888888', mirror=True,

zerolinewidth=1, zerolinecolor='#00ffff',

showgrid=True, gridwidth=1, gridcolor='#eeeeee')

fig.update_xaxes(row=3,col=1,

showline=True,linecolor='#888888', mirror=True,

showgrid=True, gridwidth=1, gridcolor='#eeeeee')

fig.update_yaxes(title_text="BB,SMA,EMA,DC", row=4, col=1,secondary_y=False,

showline=True,linecolor='#888888', mirror=True,

showgrid=True, gridwidth=1, gridcolor='#eeeeee')

fig.update_xaxes(row=4,col=1,

showline=True,linecolor='#888888', mirror=True,

showgrid=True, gridwidth=1, gridcolor='#eeeeee')

fig.update_yaxes(title_text="Volume", row=8, col=1,secondary_y=False,

showline=True,linecolor='#888888', mirror=True,

showgrid=True, gridwidth=1, gridcolor='#eeeeee')

fig.update_yaxes(title_text="OBV", row=8, col=1,secondary_y=True)

fig.update_xaxes(row=8,col=1,

showline=True,linecolor='#888888', mirror=True,

showgrid=True, gridwidth=1, gridcolor='#eeeeee')

fig.update_yaxes(title_text="CMF", row=9, col=1,secondary_y=False,

showline=True,linecolor='#888888', mirror=True,

zerolinewidth=1, zerolinecolor='#00ffff',

showgrid=True, gridwidth=1, gridcolor='#eeeeee')

fig.update_yaxes(title_text="FI", row=9, col=1,secondary_y=True,

showline=True,linecolor='#888888', mirror=True,

showgrid=True, gridwidth=1, gridcolor='#eeeeee')

fig.update_xaxes(row=9,col=1,

showline=True,linecolor='#888888', mirror=True,

showgrid=True, gridwidth=1, gridcolor='#eeeeee')

fig.update_yaxes(title_text="VPT", row=10, col=1,secondary_y=False,

showline=True,linecolor='#888888', mirror=True,

zerolinewidth=1, zerolinecolor='#00ffff',

showgrid=True, gridwidth=1, gridcolor='#eeeeee')

fig.update_yaxes(title_text="ADI", row=10, col=1,secondary_y=True,

showline=True,linecolor='#888888', mirror=True,

showgrid=True, gridwidth=1, gridcolor='#eeeeee')

fig.update_xaxes(row=10,col=1,

showline=True,linecolor='#888888', mirror=True,

showgrid=True, gridwidth=1, gridcolor='#eeeeee')

fig.update_yaxes(row=11, col=1,showline=True,linecolor='#888888',

mirror=True,showgrid=False,zeroline=False)

fig.update_xaxes(row=11,col=1,showline=True,linecolor='#888888',

mirror=True,showgrid=False,zeroline=False)

fig.update_layout(height=1600,

title_text=stockname + ' ' + strdate + ' ' + str(ratePCT)+'%',

xaxis4 = {"rangeslider": {"visible": False}},

plot_bgcolor='rgb(255,255,255)'

)

fig.update_annotations(dict(showarrow=False),row=11,col=1)

fig.show()

fig.write_image(figfilename)