It is difficult to answer this question directly. However, after narrowing the selection range, it is easier to choose the best stocks with lower risk of loss.The first choice for profitable investment is to buy top stocks. Different investors have different investment strategies, periods and goals, so stock selection indicators vary greatly. However, there is something in common, and that is to use the best indicators to select stocks to buy from the best candidate stocks. On this page, I update the top stocks the most active stocks every day for you to choose from. Next, I summarize today’s market performance. Next, I list some top stocks and how to choose these stocks. The last part presents popular candlestick patterns for reference.

Table of Contents

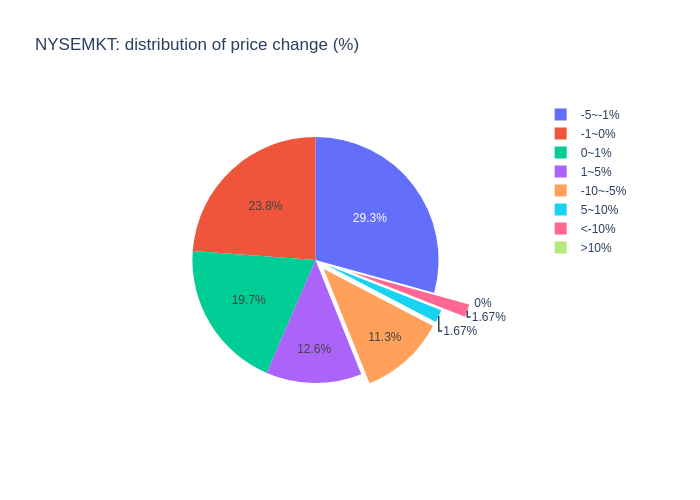

Today’s Summary

Top small capital NYSE stocks

The following stocks meet the specified conditions (💸Money flow, 🔥volume, 🚀price change, 🕯️candlestick pattern and 👀indicators).This is a short list of the complete list shown in the Screener. Click the head of the table to check the top stocks. For example, click Volume to find the most active stocks; click Change to find top gainers or top losers, etc.

| ID | Symbols | Close | Volume | Change | MF | ROC | PATTERN | nPATTERN | BULL | GLD50 | GLD20 | GLD10 | DIE50 | DIE20 | DIE10 | MFI | RSI | TSI | SR | SRs | WR | UO | MI | ADX | ADX+ | ADX- |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | NAK | 0.54 | 14823.0 | -7.07 | 8.0 | -17.08 | CLOSINGMARUBOZU LONGLINE | -2.0 | Bearish | No | No | No | No | No | No | 43.0 | 34.0 | -15.0 | -34.0 | -3.0 | -134.0 | 23.0 | 21.0 | 10.0 | 21.0 | 20.0 |

| 1 | SENS | 1.89 | 23168.0 | -4.55 | 43.0 | -30.26 | 3OUTSIDE DOJI DOJISTAR HIGHWAVE LONGLEGGEDDOJI RICKSHAWMAN SPINNINGTOP | 5.0 | Bullish | No | No | No | No | No | No | 29.0 | 31.0 | -22.0 | 10.0 | 9.0 | -89.0 | 37.0 | 21.0 | 32.0 | 11.0 | 33.0 |

| 2 | PLG | 4.62 | 1141.0 | 8.45 | 5.0 | 25.2 | CLOSINGMARUBOZU | 1.0 | Bullish | No | No | No | No | No | No | 72.0 | 63.0 | 4.0 | 100.0 | 81.0 | 0.0 | 67.0 | 22.0 | 16.0 | 27.0 | 15.0 |

| 3 | REI | 2.15 | 1845.0 | -6.11 | 3.0 | -8.51 | EVENINGDOJISTAR EVENINGSTAR LONGLINE | -3.0 | Bearish | No | No | No | No | No | No | 40.0 | 43.0 | -6.0 | 22.0 | 35.0 | -77.0 | 50.0 | 22.0 | 19.0 | 18.0 | 16.0 |

| 4 | EMAN | 2.6 | 1567.0 | -9.09 | 4.0 | -19.25 | HIKKAKE INVERTEDHAMMER | 2.0 | Bullish | No | No | No | No | No | No | 48.0 | 32.0 | -14.0 | 1.0 | 12.0 | -98.0 | 38.0 | 23.0 | 17.0 | 16.0 | 32.0 |

| 5 | ZDGE | 12.73 | 497.0 | -5.14 | 6.0 | 17.54 | 3OUTSIDE BELTHOLD CLOSINGMARUBOZU LONGLINE MARUBOZU | -5.0 | Bearish | No | No | No | No | No | No | 41.0 | 49.0 | 9.0 | 49.0 | 63.0 | -50.0 | 37.0 | 24.0 | 19.0 | 21.0 | 15.0 |

| 6 | XXII | 3.21 | 2658.0 | -8.55 | 8.0 | 7.36 | BELTHOLD ENGULFING LONGLINE | -3.0 | Bearish | No | No | No | No | No | No | 52.0 | 48.0 | 8.0 | 45.0 | 61.0 | -54.0 | 43.0 | 23.0 | 16.0 | 22.0 | 22.0 |

| 7 | TMBR | 1.47 | 5978.0 | -16.95 | 8.0 | -29.33 | CLOSINGMARUBOZU | -1.0 | Bearish | No | No | No | No | No | Yes | 53.0 | 37.0 | -5.0 | -33.0 | 2.0 | -133.0 | 23.0 | 22.0 | 21.0 | 19.0 | 19.0 |

| 8 | TKAT | 20.86 | 462.0 | -5.53 | 9.0 | -38.83 | CLOSINGMARUBOZU LONGLINE | -2.0 | Bearish | No | No | No | No | No | No | 71.0 | 44.0 | 8.0 | -3.0 | 3.0 | -103.0 | 19.0 | 33.0 | 38.0 | 29.0 | 22.0 |

| 9 | CRF | 11.87 | 1661.0 | -6.31 | 19.0 | -10.55 | BELTHOLD LONGLINE | -2.0 | Bearish | No | No | No | No | No | No | 31.0 | 27.0 | -3.0 | 4.0 | 39.0 | -95.0 | 42.0 | 25.0 | 16.0 | 12.0 | 36.0 |

| 10 | UUUU | 5.29 | 4223.0 | -5.37 | 22.0 | -1.67 | 3OUTSIDE | -1.0 | Bearish | No | No | No | No | No | No | 45.0 | 42.0 | 0.0 | 5.0 | 17.0 | -94.0 | 37.0 | 24.0 | 16.0 | 22.0 | 26.0 |

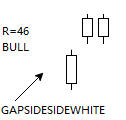

| 11 | JOB | 0.57 | 6580.0 | -1.55 | 3.0 | -58.32 | DOJI GAPSIDESIDEWHITE GRAVESTONEDOJI LONGLEGGEDDOJI SHORTLINE | 3.0 | Bullish | No | No | No | No | No | No | 3.0 | 21.0 | -33.0 | 1.0 | 1.0 | -98.0 | 26.0 | 23.0 | 28.0 | 11.0 | 41.0 |

| 12 | NSPR | 0.41 | 10148.0 | -4.65 | 4.0 | -35.94 | DOJI DOJISTAR HIGHWAVE LONGLEGGEDDOJI RICKSHAWMAN SPINNINGTOP | 2.0 | Bullish | No | No | No | No | No | No | 22.0 | 25.0 | -28.0 | 8.0 | 7.0 | -91.0 | 32.0 | 21.0 | 23.0 | 14.0 | 37.0 |

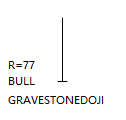

| 13 | ACY | 10.89 | 554.0 | -2.77 | 6.0 | 194.32 | DOJI GRAVESTONEDOJI INVERTEDHAMMER LONGLEGGEDDOJI RICKSHAWMAN SHORTLINE SPINNINGTOP | 3.0 | Bullish | No | No | No | No | No | No | 93.0 | 54.0 | 9.0 | 56.0 | 57.0 | -43.0 | 36.0 | 25.0 | 35.0 | 27.0 | 11.0 |

| 14 | BTN | 4.54 | 1643.0 | -1.52 | 7.0 | 80.16 | GAPSIDESIDEWHITE | 1.0 | Bullish | No | No | No | No | No | No | 91.0 | 84.0 | 49.0 | 92.0 | 93.0 | -7.0 | 77.0 | 26.0 | 27.0 | 45.0 | 7.0 |

| 15 | PLX | 6.2 | 1619.0 | 3.85 | 10.0 | 37.47 | HIGHWAVE SPINNINGTOP | 2.0 | Bullish | No | No | No | No | No | No | 83.0 | 71.0 | 24.0 | 88.0 | 91.0 | -11.0 | 61.0 | 23.0 | 31.0 | 36.0 | 9.0 |

| 16 | ITP | 0.51 | 6801.0 | 0.0 | 3.0 | -20.31 | DOJI HIGHWAVE LONGLEGGEDDOJI SPINNINGTOP | 4.0 | Bullish | No | No | No | No | No | No | 47.0 | 29.0 | -26.0 | 16.0 | 8.0 | -83.0 | 37.0 | 21.0 | 17.0 | 18.0 | 35.0 |

| 17 | GORO | 2.92 | 1234.0 | 0.34 | 3.0 | 14.06 | BELTHOLD | 1.0 | Bullish | No | No | No | No | No | No | 78.0 | 56.0 | 5.0 | 92.0 | 78.0 | -7.0 | 58.0 | 23.0 | 13.0 | 21.0 | 13.0 |

| 18 | UTG | 34.67 | 169.0 | -0.83 | 5.0 | 3.93 | BELTHOLD | 1.0 | Bullish | No | No | No | No | No | No | 74.0 | 69.0 | 41.0 | 83.0 | 88.0 | -16.0 | 65.0 | 24.0 | 38.0 | 33.0 | 6.0 |

| 19 | TGB | 1.91 | 3149.0 | 0.53 | 6.0 | 13.69 | HIGHWAVE SPINNINGTOP | 2.0 | Bullish | No | No | No | No | No | No | 52.0 | 60.0 | 11.0 | 86.0 | 76.0 | -13.0 | 50.0 | 23.0 | 14.0 | 26.0 | 16.0 |

| 20 | STXS | 8.25 | 857.0 | -1.55 | 7.0 | 24.43 | DOJI GRAVESTONEDOJI HIGHWAVE LONGLEGGEDDOJI SPINNINGTOP | 5.0 | Bullish | No | No | No | No | No | No | 76.0 | 66.0 | 26.0 | 83.0 | 87.0 | -16.0 | 54.0 | 23.0 | 27.0 | 29.0 | 9.0 |

| 21 | MAG | 17.51 | 485.0 | 1.16 | 8.0 | 21.6 | HANGINGMAN | -1.0 | Bearish | No | No | No | No | No | No | 66.0 | 56.0 | 0.0 | 95.0 | 85.0 | -4.0 | 57.0 | 22.0 | 16.0 | 26.0 | 16.0 |

| 22 | BTG | 5.11 | 8778.0 | 2.61 | 44.0 | 21.09 | HANGINGMAN | -1.0 | Bearish | No | No | No | No | No | No | 67.0 | 64.0 | 9.0 | 100.0 | 90.0 | 0.0 | 65.0 | 23.0 | 18.0 | 30.0 | 13.0 |

| 23 | GTE | 0.65 | 4662.0 | -3.27 | 3.0 | -4.69 | HIKKAKE INVERTEDHAMMER | 2.0 | Bullish | No | No | No | No | No | No | 38.0 | 40.0 | -16.0 | 18.0 | 39.0 | -81.0 | 42.0 | 21.0 | 16.0 | 20.0 | 24.0 |

| 24 | BRG | 9.3 | 326.0 | -1.17 | 3.0 | -11.34 | HIKKAKE | 1.0 | Bullish | No | No | No | No | No | No | 11.0 | 34.0 | -26.0 | 7.0 | 8.0 | -92.0 | 40.0 | 23.0 | 22.0 | 10.0 | 24.0 |

| 25 | VHC | 4.95 | 714.0 | 0.61 | 3.0 | -7.65 | HIGHWAVE SPINNINGTOP | 2.0 | Bullish | No | No | No | No | No | No | 28.0 | 31.0 | -32.0 | 18.0 | 9.0 | -81.0 | 39.0 | 22.0 | 38.0 | 11.0 | 32.0 |

| 26 | BLE | 15.13 | 208.0 | -0.13 | 3.0 | 0.4 | DOJI GRAVESTONEDOJI LONGLEGGEDDOJI RICKSHAWMAN SHORTLINE SPINNINGTOP | 6.0 | Bullish | No | No | No | No | No | No | 28.0 | 44.0 | 3.0 | 19.0 | 23.0 | -80.0 | 41.0 | 25.0 | 19.0 | 25.0 | 26.0 |

| 27 | DSS | 2.97 | 1234.0 | -1.66 | 3.0 | -16.57 | CLOSINGMARUBOZU | -1.0 | Bearish | No | No | No | No | No | No | 25.0 | 33.0 | -18.0 | 0.0 | 4.0 | -100.0 | 27.0 | 23.0 | 21.0 | 13.0 | 30.0 |

| 28 | KLR | 13.1 | 446.0 | -4.03 | 5.0 | -9.66 | CLOSINGMARUBOZU | -1.0 | Bearish | No | No | No | No | No | No | 19.0 | 35.0 | -15.0 | -1.0 | 3.0 | -101.0 | 37.0 | 21.0 | 18.0 | 12.0 | 21.0 |

| 29 | IBIO | 1.23 | 4722.0 | -4.65 | 5.0 | -18.0 | LONGLINE | -1.0 | Bearish | No | No | No | No | No | No | 22.0 | 32.0 | -22.0 | 2.0 | 8.0 | -97.0 | 39.0 | 22.0 | 32.0 | 10.0 | 32.0 |

| 30 | UEC | 2.75 | 3857.0 | -2.14 | 10.0 | -1.43 | 3OUTSIDE | -1.0 | Bearish | No | No | No | No | No | No | 46.0 | 48.0 | 8.0 | 10.0 | 17.0 | -89.0 | 40.0 | 25.0 | 36.0 | 25.0 | 17.0 |

| 31 | EVV | 12.63 | 419.0 | -0.32 | 5.0 | -0.08 | BELTHOLD CLOSINGMARUBOZU ENGULFING LONGLINE MARUBOZU | -5.0 | Bearish | No | Yes | No | No | No | No | 57.0 | 49.0 | 0.0 | 38.0 | 42.0 | -61.0 | 45.0 | 23.0 | 8.0 | 20.0 | 16.0 |

| 32 | NGD | 1.79 | 5358.0 | -2.19 | 9.0 | 17.76 | BELTHOLD ENGULFING LONGLINE | -3.0 | Bearish | No | Yes | No | No | No | No | 59.0 | 54.0 | 7.0 | 74.0 | 76.0 | -25.0 | 45.0 | 23.0 | 23.0 | 26.0 | 13.0 |

The 👀NYSEMKT STOCK SCREENER and 📈CHART LIST

How is this short list created

In this section, I have listed selected stocks that meet the following conditions:

- Top 25% according to Money Flow (MF)

- Each stock matches at least one candlestick pattern

and also meet at least one of the following conditions:

- The most active stocks (top 5% by trading volume)

- Top gainers (daily price changes > 3%)

- Top losers (daily price changes < -3%)

- Significant uptrend in the last 12-day (ROC>30%)

- Significant downtrend in the last 12-day (ROC<-30%)

- Probable over-bought defined by RSI (RSI>70)

- Probable over-sold defined by RSI (RSI<30)

- Probable over-bought defined by SR (SR>80)

- Probable over-sold defined by SR (RSI<20)

- Probable over-bought defined by WR (WR>-20)

- Probable over-sold defined by WR (WR<-80)

- Golden cross: 50-day MA crossed above 200-day MA within the last week

- Golden cross: 20-day MA crossed above 50-day MA within the 3-day

- Golden cross: 10-day MA crossed above 20-day MA today

- Death cross: 50-day MA crossed blow 200-day MA within the last week

- Death cross: 20-day MA crossed blow 50-day MA within the 3-day

- Death cross: 10-day MA crossed blow 20-day MA today

- nPATTERN: sum (-1,-2 : bearish +1,+2 : bullish, strong signal (-2|+2)

🕯️🕯️🕯️🕯️🕯️🕯️🕯️🕯️🕯️🕯️🕯️🕯️🕯️🕯️🕯️🕯️🕯️🕯️🕯️🕯️🕯️🕯️🕯️🕯️

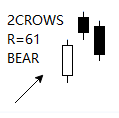

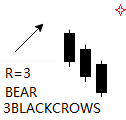

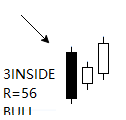

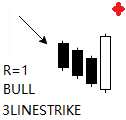

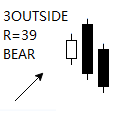

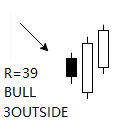

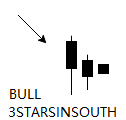

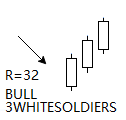

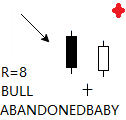

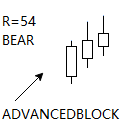

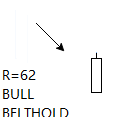

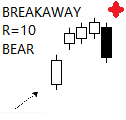

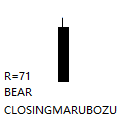

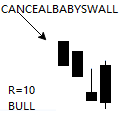

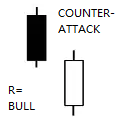

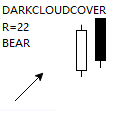

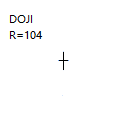

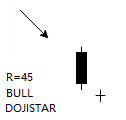

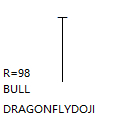

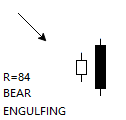

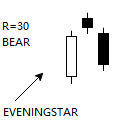

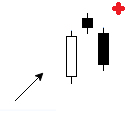

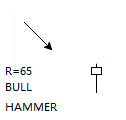

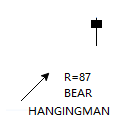

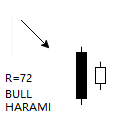

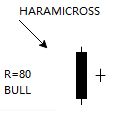

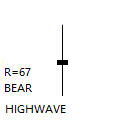

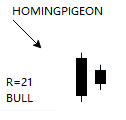

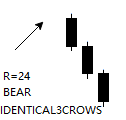

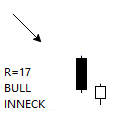

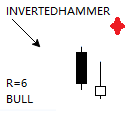

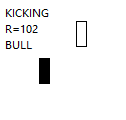

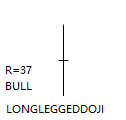

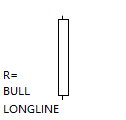

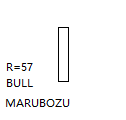

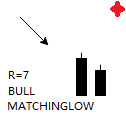

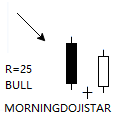

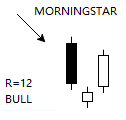

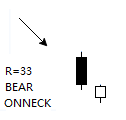

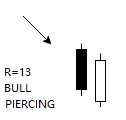

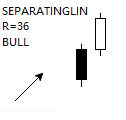

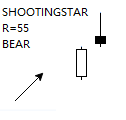

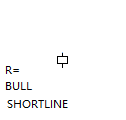

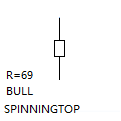

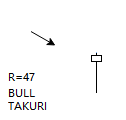

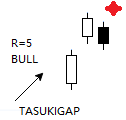

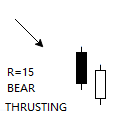

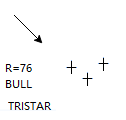

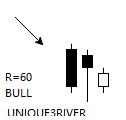

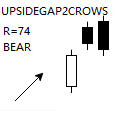

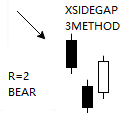

Candlestick patterns for reference

(R: rank, top 10 were marked with red +)